We live in a world where people expect instant responses tailor-made to their needs. Conversational AI will deliver instant responses while personalising the experience to match a client’s needs, resulting in better client relationships and lead generation. As marketing strategies are frequently evolving, it is essential to accommodate the needs and wants of customers. Conversational AI is a boon for twenty-first-century businesses connecting with customers.

What is Conversational AI?

Conversational AI is a tech-driven artificial intelligence that uses Natural Language Processing (NLP) to converse, similar to a natural conversation in a technical environment. The conversation is as natural as a human conversation. The AI relies on machine learning codes and NLP, integrated with chatbots, to understand human conversation.

However, Conversational AI can offer hyper-personalised experiences to businesses whose customers expect a personalised conversation. Chatbots can also improve the customer experience and generate leads that can facilitate and convert into business without much effort. Predominantly, the conversation is guided and not scripted, giving a personalised experience for each customer.

Why should the insurance industry invest in Conversational AI chatbots?

Following the pandemic, people have realised the importance of insurance and started investing in health and other policies. As a result, there is a massive spike in the number of enquiries made to insurance companies. However, handling those numbers with limited human resources and other limitations might be challenging.

Besides, when an existing customer wants to renew their policy which is about to mature or upgrade to a new policy with their existing data, the company has to employ a customer relations manager or an associate to understand and explain what that customer needs.

Considering a hundred requests on the same day, the company must invest in additional human resources or take time to deliver what the customer wants. Both of these will not convert the lead into business as a company cannot spend more than the allocated budget for human resources. At the same time, there are varied options and offers available for customers to choose from competing insurance companies.

Suppose a customer wants to claim their insurance. In that case, however, they must get in touch with the insurance company and explain their claim to the client relations manager or associate. The manager must understand their situation, review their policy and help them with a rightful claim or shift their case to another person. Considering the limitation on the available human resources and systems in place for the employee to handle customers, a company has to invest a lot.

Conversational AI in insurance comes as a boon and solution for the insurance industry. Conversational AI chatbots can handle any number of customers 24/7/365 without any interruption.

Intelligent Insurance assistant chatbots can also help reduce costs in terms of customer service management while improving the efficiency of the service offered. Automated bots with hyper-personalisation are more efficient in handling customer inquiries than humans, provided all the data required for the conversation is configured in the backend of the software. Bots handle more than a human resource call centre can handle simultaneously. This also reduces the cost incurred by the insurance company’s investment in their Customer Relationship Management (CRM) solutions.

How can Conversational AI chatbots change lead to customer conversion in the insurance industry?

With a more personalised experience and Intelligent automation in Insurance with Conversational AI, the insurance industry can serve its customers more personally. Hyper-personalization with Conversational AI not only increases the experience and satisfaction of the customers but converts the leads into generating business and revenue with fewer human resources.

Leads can be converted into customers using the data collected through different Conversational AI chatbots while understanding the customer’s preferences and needs through the hyper-personalised question.

Instant and efficient customer service helps insurance companies satisfy their customers. A happy customer brings you new leads and customers. This small integration can impact your revenue. Hyper personalised Conversation AI becomes integral to your business.

Conversation AI chatbots can handle many customers simultaneously. While handling many customers, these bots can automate many things while functioning 24/7 throughout the year. With insurance automation solutions, every customer’s needs are prioritised, and their concerns are sorted quickly and easily without waiting on hold like the traditional methods of customer service or navigating through a complex website. This makes their experience better and increases their satisfaction.

What can be changed in the insurance industry using Conversational AI chatbots?

Conversational AI chatbots help improve customer engagement and new lead conversion rates. Automated bots engage the customers quickly and easily. This makes the customer more likely to engage with your website or stay on chat with you for longer. Similarly, increasing this engagement and customer satisfaction can result in a higher lead conversion rate.

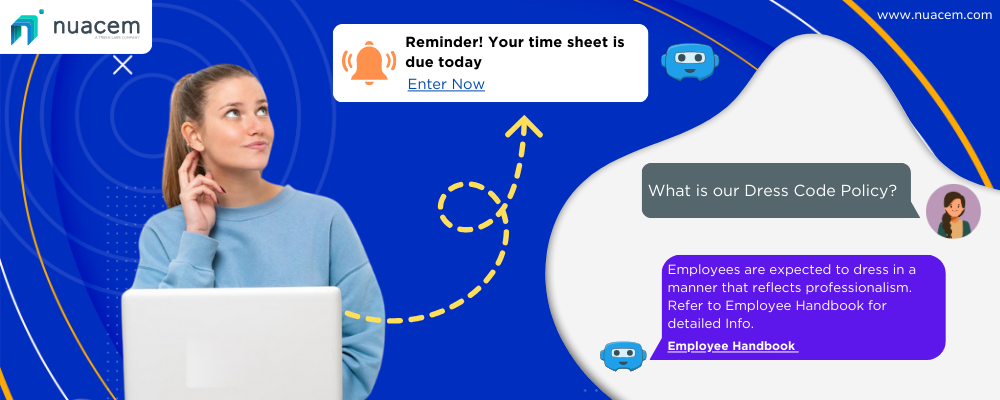

Additionally, Conversational AI chatbots can improve your business conversion rate by sending reminders regarding the inquired policy from a particular lead. A bot can help customers compare plans and choose the right one based on their needs in significantly less time than a human agent. It will be convenient and engaging for customers to chat with a bot regarding their policies or automated claims processing rather than waiting to talk to an agent or looking up on the websites or portals.

Similarly, an AI-powered chatbot for Insurance can be implemented for the following reasons:

- Policy enquiry

- Automate Insurance Claims

- Comparing policies

- Buying a policy

- Calculating premium

- Insurance advisory

- Insurance Renewal

- Knowing customers

- Feedback & reviews

- Conversational claim

- Real-time lead qualification

- Customer engagement

- Reducing digital frauds

- Claim submission

- FAQs

- Policy status

- Schedule payment

- Claim submission

- Policy enrolment

- Update policy

- Change beneficiary

- Edit details

- Premium certificate

Way forward in the insurance industry:

Insurance virtual assistants become vital as the times change. Instant solutions and claims are what the world is looking for in the insurance industry. For example, a customer recommends our brand and stays loyal only if they experience a positive experience from you. Conversational AI helps improve customer satisfaction by engaging and personalising the unique experience for each customer.

People have started investing in insurance post-pandemic, and insurance companies have become inevitable to show rapid interest and make a quick turnaround in the business. Companies need to invest in Intelligent IVR Solutions for Insurance because

- AI Bots are available 24*7

- One bot can interact with any number of customers simultaneously

- Every customer is handled personally by the bot

- Investment is lesser compared to a human CRM team

- Lead conversion rates are higher with bots

- Conversational AI chatbots are an intelligent business growth investment for a more valued customer base and business while deploying virtual assistants for insurance agents, reducing a human agent’s workload.